Some Known Questions About Paul B Insurance.

Paul B Insurance Can Be Fun For Everyone

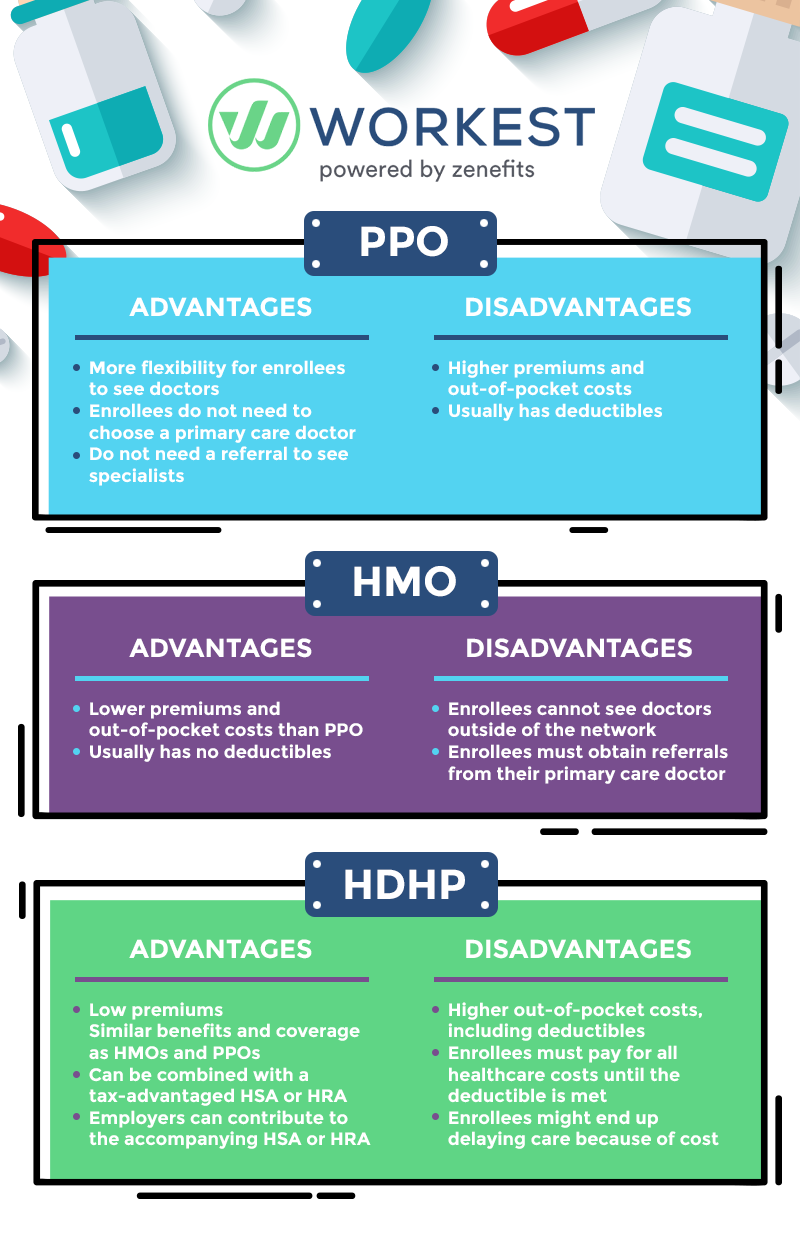

Related Topics One factor insurance concerns can be so confounding is that the medical care market is continuously transforming and the protection intends provided by insurance companies are hard to categorize. In various other words, the lines in between HMOs, PPOs, POSs and other kinds of insurance coverage are frequently blurred. Still, recognizing the make-up of various plan types will be handy in reviewing your choices.

PPOs usually use a larger choice of providers than HMOs. Costs may resemble or a little more than HMOs, and out-of-pocket prices are normally higher and also much more complicated than those for HMOs. PPOs permit participants to venture out of the provider network at their discernment and do not call for a recommendation from a medical care physician.

When the deductible amount is gotten to, additional health and wellness expenses are covered based on the provisions of the medical insurance policy. A worker could after that be responsible for 10% of the expenses for treatment obtained from a PPO network service provider. Deposits made to an HSA are tax-free to the company and also employee, and money not invested at the end of the year might be surrendered to spend for future medical expenses.

The Paul B Insurance Ideas

(Employer contributions must coincide for all employees.) Workers would be accountable for the first $5,000 in clinical prices, yet they would certainly each have $3,000 in their personal HSA to pay for medical expenses (and also would certainly have also a lot more if they, as well, added to the HSA). If workers or their family members tire their $3,000 HSA part, they would certainly pay the next $2,000 out of pocket, whereupon the insurance plan would certainly begin to pay.

There is no limitation on the amount of cash a company can add to worker accounts, however, the accounts might not be funded via employee wage deferrals under a cafeteria strategy. Additionally, companies are not permitted to reimburse any component of the balance to workers.

Do you recognize when the most fantastic time of the year is? The enchanting time of year when you get to compare wellness insurance coverage plans to see which one is ideal for you! Okay, you got us.

Paul B Insurance for Beginners

When it's time to choose, it's essential to understand what each strategy covers, exactly how much it costs, as well as where you can use it? This stuff can feel challenging, yet it's less complicated than it appears. We placed with each other some sensible understanding actions to aid you really feel certain concerning your choices.

(See what we did there?) Emergency care is usually the exception to the policy. These plans are the most prominent for individuals who get their medical insurance through work, with 47% of covered employees enlisted in a PPO.2 Pro: The Majority Of PPOs have a suitable option of carriers to pick from in your location.

Disadvantage: Higher costs make PPOs a lot more costly than other kinds of plans like HMOs. A health upkeep organization is a health insurance policy strategy that typically just covers treatment from doctors that benefit (or contract with) that specific strategy.3 Unless there's an emergency, your strategy will not pay for out-of-network treatment.

The 10-Minute Rule for Paul B Insurance

More like Michael Phelps. It's excellent to know that plans in every category supply some kinds of cost-free preventative treatment, and also some deal free or discounted health care solutions prior to you fulfill your insurance deductible.

Bronze strategies have the most affordable regular monthly premiums but the greatest out-of-pocket expenses. As you work your method up through the Silver, Gold as well as Platinum groups, you pay extra in costs, yet much less in deductibles as well as coinsurance. As we pointed out previously, the extra prices in the Silver classification can be lessened if you qualify for the cost-sharing reductions.

Reductions can decrease your out-of-pocket medical care sets you back a great deal, so get with one of our Endorsed Local Suppliers (ELPs) who can assist you discover what you may be eligible for. The table below programs the percentage that the insurer paysand what you payfor covered costs after you meet your insurance deductible in each strategy category.

Unknown Facts About Paul B Insurance

Various other expenses, frequently called "out-of-pocket" prices, can include up quickly. Points like your deductible, your copay, your coinsurance quantity as well as your out-of-pocket optimum can have a huge effect on the overall price. Right here are some expenses to maintain close tabs on: Deductible the amount you pay prior to your insurance provider pays anything (besides free preventative treatment) Copay a set amount you see this website pay each time for points like doctor you can try this out brows through or other solutions Coinsurance - the percent of medical care solutions you are accountable for paying after visite site you have actually hit your insurance deductible for the year Out-of-pocket maximum the annual restriction of what you are accountable for paying by yourself One of the very best means to save money on wellness insurance is to utilize a high-deductible health insurance (HDHP), particularly if you don't expect to regularly utilize clinical solutions.

These job quite much like the other health insurance programs we described already, but technically they're not a form of insurance policy.

If you're attempting the do it yourself course and also have any sticking around inquiries regarding wellness insurance policy strategies, the professionals are the ones to ask. As well as they'll do greater than just address your questionsthey'll additionally discover you the very best price! Or maybe you would certainly like a way to integrate obtaining wonderful medical care protection with the possibility to help others in a time of requirement.

Paul B Insurance Can Be Fun For Anyone

Our relied on partner Christian Healthcare Ministries (CHM) can assist you figure out your choices. CHM helps family members share healthcare prices like medical examinations, maternity, a hospital stay and also surgical treatment. Thousands of people in all 50 states have actually used CHM to cover their health care needs. Plus, they're a Ramsey, Relied on partner, so you understand they'll cover the clinical bills they're meant to and also honor your insurance coverage.

Key Concern 2 Among things healthcare reform has actually carried out in the united state (under the Affordable Care Act) is to introduce more standardization to insurance coverage strategy benefits. Prior to such standardization, the advantages supplied varied substantially from strategy to plan. For instance, some plans covered prescriptions, others did not.